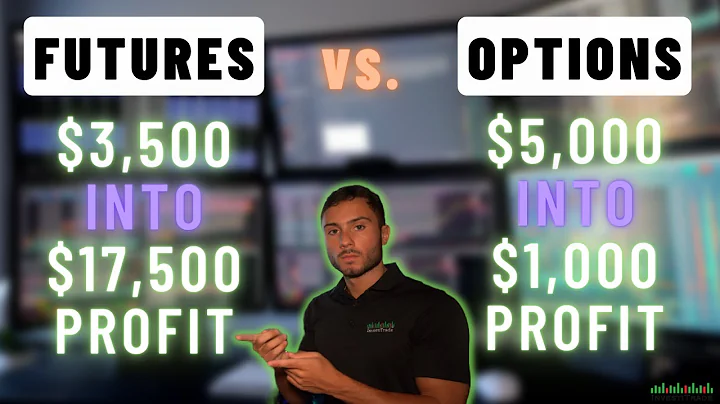

Is it better to trade futures or options?

Futures have several advantages over options in the sense that they are often easier to understand and value, have greater margin use, and are often more liquid. Still, futures are themselves more complex than the underlying assets that they track. Be sure to understand all risks involved before trading futures.

A future is a contract to buy or sell an underlying stock or other assets at a pre-determined price on a specific date. On the other hand, options contract gives an opportunity to the investor the right but not the obligation to buy or sell the assets at a specific price on a specific date, known as the expiry date.

Options generally are a higher-risk, higher-reward opportunity than stocks. Investors considering them should know all their benefits and drawbacks.

In a Futures contract, there is an obligation to buy or sell assets at a predetermined price and time. Options, however, give the buyer the right but not the obligation to trade . They carry great potential for making substantial profits.

Where futures and options are concerned, your level of tolerance of risk may be a contributing variable, but it's a given that futures are more risky than options. Even slight shifts that take place in the price of an underlying asset affect trading, more than that while trading in options.

Overview: Swing trading is an excellent starting point for beginners. It strikes a balance between the fast-paced day trading and long-term investing.

Buying options means limited risk, but you rarely make money. Many small F&O traders prefer to buy options as their risk is limited to the premium paid. Option sellers take more risks and earn more than option buyers more often. However, it is prudent to remember that there is limited risk when buying options.

- Understanding the market and choosing a trading strategy. Before starting trade in f&o, it is essential to understand the market and the instruments. ...

- Placing an order. Once a trading strategy is in place, the next step is to place an order. ...

- Monitoring the trade and closing the position.

The key difference between the two is that futures require the contract holder to buy the underlying asset on a specific date in the future, while options -- as the name implies -- give the contract holder the option of whether to execute the contract.

1. Which one is safer futures or options? Options are generally considered safer than futures because the potential loss in options trading is limited to the premium paid, whereas futures carry higher risk due to potential unlimited losses resulting from leverage and market movements.

What is the most risky trading?

- Stocks of Emerging Companies. ...

- Cryptocurrencies. ...

- Leveraged Trading. ...

- Venture Capital Investment. ...

- Angel Investing. ...

- Initial Public Offerings (IPOs) ...

- Alternative Investment Funds (AIFs) ...

- Foreign Exchange Trading (Forex)

1 you would see that you held an unprofitable position and simply allow the contract to expire without exercising it. However, this makes options contracts significantly more expensive than futures.

When trading futures vs. stocks, there are no rules requiring a minimum account balance or restricting how many trades can be placed in a week. As a futures trader, you can trade long or short multiple times a day or week without worrying about day trading restrictions.

Narrator: One use of a futures contract is to allow a business or individual to navigate risk and uncertainty. Prices are always changing, but with a futures contract, people can lock in a fixed price to buy or sell at a future date. Locking in a price lessens the risk of being negatively impacted by price change.

Lack of discipline is a major shortcoming.

Trading against the trend, especially without reasonable stops, and insufficient capital to trade with and/or improper money management are major causes of large losses in the futures markets; however, a large capital base alone does not guarantee success.

Future contracts have numerous advantages and disadvantages. The most prevalent benefits include simple pricing, high liquidity, and risk hedging. The primary disadvantages are having no influence over future events, price swings, and the possibility of asset price declines as the expiration date approaches.

While futures can pose unique risks for investors, there are several benefits to futures over trading straight stocks. These advantages include greater leverage, lower trading costs, and longer trading hours.

That said, generally speaking, futures trading is often considered riskier than stock trading because of the high leverage and volatility involved that can expose traders to significant price moves.

Futures tend to be riskier as they are directly aligned to the asset prices and their volatility. On the other hand, Options react differently to the underlying asset price movements and allow you relatively more time to manoeuvre and curtail losses. Further, the critical difference between Futures vs.

You don't have to have the margin in place to buy options on a futures contract, and your loss is limited to the premium no matter what direction the underlying moves. When selling options on a futures contract, your maximum loss is unlimited, while your maximum profit is limited to the premium.

Why not to trade in futures and options?

At the end of the day, futures' trading is leveraged and therefore you have to keep strict stop losses and profit targets while trading. In fact, the need for stop losses and profit targets is a lot more intense in futures than in cash due to the leverage involved.

Risk management is crucial in futures trading to minimize losses and keep you trading. Fundamental principles of risk management include setting stop-loss orders and diversification. Risk management strategies involve position sizing, technical analysis, and monitoring market conditions.

References

- https://www.bajajfinserv.in/futures-contract

- https://www.indeed.com/career-advice/career-development/80-20-rule-marketing

- https://www.timothysykes.com/blog/how-to-day-trade-without-25k/

- https://www.cmegroup.com/education/courses/understanding-the-benefits-of-futures/the-benefits-of-day-trading-futures.html

- https://www.linkedin.com/pulse/stock-price-predictions-using-deep-learning-muhammad-nouman

- https://groww.in/p/difference-between-options-and-futures

- https://optimusfutures.com/blog/futures-trading-success-rates/

- https://www.5paisa.com/stock-market-guide/derivatives-trading/what-is-an-index-call

- https://www.investopedia.com/terms/p/paretoprinciple.asp

- https://www.temok.com/blog/chat-gpt-stock/

- https://www.schwab.com/futures/what-are-futures

- https://www.samco.in/how-trade-in-fno

- https://www.icicidirect.com/ilearn/futures-and-options/articles/advantages-of-options-over-futures

- https://www.schwab.com/learn/story/trader-taxes-form-8949-section-1256-contracts

- https://yellow.systems/blog/chatgpt-and-the-stock-market

- https://corporatefinanceinstitute.com/resources/derivatives/stock-index-futures/

- https://groww.in/p/what-is-index-futures

- https://tradeproacademy.com/power-of-volume-profile-in-futures-trading/

- https://www.5paisa.com/stock-market-guide/derivatives-trading/what-are-stock-index-futures

- https://www.binance.com/en/square/post/1424550

- https://www.investopedia.com/articles/active-trading/020216/five-advantages-futures-over-options.asp

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10513304/

- https://tradesmartonline.in/knowledge-hub/futures-options/future-pricing-formula-the-complete-guide/

- https://www.kotaksecurities.com/intraday-trading/intraday-trading-guide-for-beginners/

- https://www.investordaily.com.au/technology/54002-chatgpt-can-forecast-stock-price-movements-study-finds

- https://www.nature.com/articles/s41599-024-02807-x

- https://www.linkedin.com/pulse/what-most-profitable-form-trading-best-trader-cau2c

- https://www.nasdaq.com/articles/how-much-money-needed-start-trading-futures-2016-02-19

- https://byjus.com/maths/index/

- https://www.fool.com/investing/how-to-invest/stocks/futures-vs-options/

- https://finimize.com/content/how-use-chatgpt-analyze-stock

- https://www.investopedia.com/ask/answers/how-to-invest-in-an-index/

- https://www.poems.com.sg/glossary/trading-terms/trade-sizing/

- https://www.indiainfoline.com/knowledge-center/derivatives/what-are-the-risks-of-futures-contract

- https://groww.in/p/types-of-futures

- https://www.zippia.com/salaries/futures-trader/

- https://trendspider.com/learning-center/understanding-point-of-control-a-guide-for-investors-and-traders/

- https://www.geeksforgeeks.org/ai-tools-for-stock-trading-price-predictions/

- https://asana.com/resources/pareto-principle-80-20-rule

- https://www.bajajfinserv.in/intraday-trading

- https://www.ig.com/en/futures-trading/what-are-futures-how-do-you-trade-them

- https://www.linkedin.com/pulse/what-90-rule-forex-broker-forex-global-czp0c

- https://www.shadowtrader.net/glossary/eighty-percent-rule/

- https://ninjatrader.com/futures/why-trade-futures/futures-vs-stocks-options/

- https://www.investopedia.com/ask/answers/031015/how-risky-are-futures.asp

- https://smartasset.com/investing/futures-vs-stocks

- https://www.fisdom.com/which-is-better-futures-or-options/

- https://www.linkedin.com/pulse/futures-trading-strategies-quantifiedstrategies-yt6of

- https://www.angelone.in/knowledge-center/intraday-trading/5-strategies-for-successful-intraday-trading

- https://bookmap.com/blog/day-trading-futures-strategies-risks-and-rewards-explained/

- https://www.bankrate.com/investing/options-vs-stocks/

- https://www.vantagemarkets.com/en/academy/index-vs-stock-trading/

- https://smartasset.com/financial-advisor/futures-vs-options

- https://www.investopedia.com/terms/1/80-20-rule.asp

- https://www.techtarget.com/whatis/definition/Pareto-principle

- https://www.danerwealth.com/blog/the-terrible-track-record-of-wall-street-forecasts

- https://www.tradersmastermind.com/a-look-at-the-best-ever-trades-in-history/

- https://www.schwab.com/futures/faqs

- https://www.techopedia.com/investing/most-accurate-stock-predictors

- https://www.investopedia.com/terms/f/fiftypercentprinciple.asp

- https://www.investopedia.com/articles/active-trading/091714/basics-options-profitability.asp

- https://en.wikipedia.org/wiki/Stock_market_index

- https://www.thriday.com.au/blog-posts/the-dummies-guide-to-the-pareto-principle-80-20-rule

- https://www.linkedin.com/pulse/what-type-trading-should-beginner-start-prince-john-paul-rpige

- http://www.zaner.com/3.0/education/content.asp?page=ondemand/50rwftlm.html

- https://www.fxstreet.com/education/golden-rules-of-trading-202312051327

- https://www.tastylive.com/concepts-strategies/futures-options

- https://markets.businessinsider.com/premarket

- https://www.fisdom.com/how-to-predict-stock-price-for-next-day/

- https://www.investopedia.com/articles/active-trading/090115/use-market-volume-data-determine-bottom.asp

- https://poe.com/poeknowledge/1512928000358234

- https://www.investopedia.com/articles/stocks/10/stock-analysts.asp

- https://www.schwab.com/learn/story/7-tips-every-futures-trader-should-know

- https://www.moneyshow.com/articles/daytraders-28139/

- https://www.geeksforgeeks.org/ai-tools-for-stock-market-analysis/

- https://www.investopedia.com/articles/active-trading/052214/trading-options-futures-contracts.asp

- https://www.investopedia.com/articles/trading/09/how-to-trade-for-a-living.asp

- https://www.investopedia.com/terms/p/pricetarget.asp

- https://www.5paisa.com/stock-market-guide/derivatives-trading-basics/what-is-futures-and-options

- https://www.5paisa.com/stock-market-guide/derivatives-trading/about-futures-contract

- https://www.ig.com/en/glossary-trading-terms/stock-index-definition

- https://www.kotaksecurities.com/support/what-will-happen-to-my-intraday-mis-or-co-position-in-case-the-stock-circuit-limits-are-hit/

- https://www.investopedia.com/articles/optioninvestor/09/get-started-with-futures.asp

- https://www.icicidirect.com/futures-and-options/articles/understanding-volume-profile-indicator

- https://www.bajajfinserv.in/futures-and-options

- https://time.com/personal-finance/article/how-to-invest-in-index-funds/

- https://www.smallcase.com/learn/types-of-stock-market-trading/

- https://www.investopedia.com/articles/stocks/12/most-shocking-stock-increases-falls.asp

- https://www.cnbc.com/2022/01/02/the-most-accurate-analysts-on-wall-street-in-2021.html

- https://www.angelone.in/knowledge-center/futures-and-options/futures-trading

- https://intrinio.com/blog/how-to-predict-stock-prices-using-linear-regression

- https://www.motilaloswal.com/blog-details/what-you-must-avoid-when-trading-in-futures-and-options/1991

- https://tradethatswing.com/the-1-risk-rule-for-day-trading-and-swing-trading/

- https://www.cec.health.nsw.gov.au/CEC-Academy/quality-improvement-tools/pareto-charts

- https://www.investopedia.com/ask/answers/050115/what-are-some-reallife-examples-8020-rule-pareto-principle-practice.asp

- https://www.investopedia.com/articles/active-trading/032515/advantages-trading-futures-over-stocks.asp

- https://www.investopedia.com/terms/f/futurescontract.asp

- https://www.investopedia.com/terms/m/marketindex.asp

- https://bookmap.com/blog/5-of-the-best-trades-of-all-time/

- https://jamapunji.pk/knowledge-center/risks-involved-futures-contracts

- https://ninjatrader.com/futures/why-trade-futures/futures-vs-stocks/

- https://www.warriortrading.com/pattern-day-trader-rule/

- https://shahmm.medium.com/beyond-the-pareto-principle-why-80-20-is-a-flawed-rule-to-follow-2b00e9a81b4

- https://www.investopedia.com/insights/introduction-to-stock-market-indices/

- https://www.motilaloswal.com/blog-details/which-is-more-risky-futures-trading-or-options-trading/20719

- https://www.analyticsvidhya.com/blog/2023/12/building-a-personalized-ai-trading-consultant-with-gpt-4/

- https://www.investopedia.com/ask/answers/06/futureshedge.asp

- https://fi.money/blog/posts/the-80-20-rule-what-is-it-how-it-works

- https://www.mypivots.com/dictionary/definition/25/80-rule

- https://www.livemint.com/market/stock-market-news/what-is-much-riskier-futures-or-options-11663925308179.html

- https://www.targetstradingpro.com/how-to-day-trade-with-1000/

- https://www.toppr.com/ask/question/what-do-you-mean-by-a-stock-index-how-is-it-calculated/

- https://m.economictimes.com/news/new-updates/four-nostradamus-predictions-for-2024-did-his-forecasts-for-2023-come-true/articleshow/106274157.cms

- https://www.arkhamintelligence.com/research/leverage-trading-in-crypto-markets

- https://www.nerdwallet.com/article/investing/started-futures-trading

- https://www.investopedia.com/articles/optioninvestor/07/money_management_futures.asp

- https://blog.quantinsti.com/algorithmic-trading-chatgpt/

- https://www.policybazaar.com/investment-plans/articles/high-risk-investment/