When was the last time we paid off the countries national debt?

By January of 1835, for the first and only time, all of the government's interest-bearing debt was paid off. Congress distributed the surplus to the states (many of which were heavily in debt). The Jackson administration ended with the country almost completely out of debt!

On January 8, 1835, president Andrew Jackson paid off the entire national debt, the only time in U.S. history that has been accomplished.

United States

The Colorado Taxpayer Bill of Rights (the TABOR amendment) also bans surpluses and requires the state to refund taxpayers in event of a budget surplus. The last time that the budget was balanced or had a surplus was the 2001 United States federal budget.

The terms “national deficit”, “federal deficit” and “U.S. deficit” have the same meaning and are used interchangeably by the U.S. Treasury. A surplus occurs when the government collects more money than it spends. The last surplus for the federal government was in 2001.

As a result, the U.S. actually did become debt free, for the first and only time, at the beginning of 1835 and stayed that way until 1837. It remains the only time that a major country was without debt.

Under current policy, the United States has about 20 years for corrective action after which no amount of future tax increases or spending cuts could avoid the government defaulting on its debt whether explicitly or implicitly (i.e., debt monetization producing significant inflation).

Answer and Explanation:

If the U.S. was to pay off their debt ultimately, there is not much that would happen. Paying off the debt implies that the government will now focus on using the revenue collected primarily from taxes to fund its activities.

→ US deficit to exceed $1.5 trillion in 2024

The US government has hit a $1.1 trillion annual deficit just halfway through the fiscal year, per the latest CBO report. If current spending continues — and there's no reason to expect otherwise — the US will overshoot its projected debt for the year by almost 50%.

If the government spends more than it takes in, then it runs a deficit. If the government takes in more than it spends, it runs a surplus. The U.S. government has run a deficit since 1970 in all but four years (1998–2001) and annual deficits are projected to increase from now to 2054.

The public includes foreign investors and foreign governments. These two groups account for 30 percent of the debt. Individual investors and banks represent 15 percent of the debt. The Federal Reserve is holding 12 percent of the treasuries issued.

When was the last time the US has a budget surplus?

During the Clinton presidency, the federal government was able to reduce spending and increase revenues, turning a large deficit into a small surplus. The last year where the government ran a budget surplus was in 2001.

One of the main culprits is consistently overspending. When the federal government spends more than its budget, it creates a deficit. In the fiscal year of 2023, it spent about $381 billion more than it collected in revenues. To pay that deficit, the government borrows money.

The $34 trillion gross federal debt equals debt held by the public plus debt held by federal trust funds and other government accounts. In very basic terms, this can be thought of as debt that the government owes to others plus debt that it owes to itself. Learn more about different ways to measure our national debt.

Around 23% of Americans are debt free, according to the most recent data available from the Federal Reserve. That figure factors in every type of debt, from credit card balances and student loans to mortgages, car loans and more.

| Characteristic | National debt in relation to GDP |

|---|---|

| Macao SAR | 0% |

| Brunei Darussalam | 2.06% |

| Kuwait | 3.08% |

| Hong Kong SAR | 4.27% |

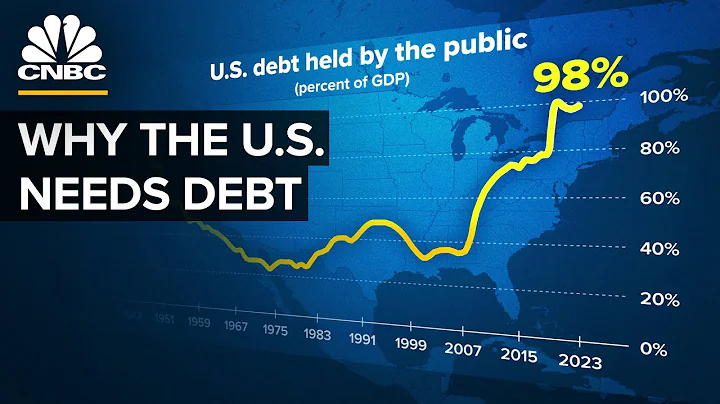

United States. The United States boasts both the world's biggest national debt in terms of dollar amount and its largest economy, which resolves to a debt-to GDP ratio of approximately 128.13%. The United States' government's spending exceeds its income most years, and the US has not had a budget surplus since 2001.

The federal government needs to borrow money to pay its bills when its ongoing spending activities and investments cannot be funded by federal revenues alone. Decreases in federal revenue are largely due to either a decrease in tax rates or individuals or corporations making less money.

China is one of the United States's largest creditors, owning about $859.4 billion in U.S. debt. 1 However, it does not own the most U.S. debt of any foreign country.

Rising debt means fewer economic opportunities for Americans. Rising debt reduces business investment and slows economic growth. It also increases expectations of higher rates of inflation and erosion of confidence in the U.S. dollar.

Under normal conditions, the Treasury sends Social Security payments one month in arrears. That means the check you receive in June covers your benefits for the month of May. If the debt ceiling isn't raised, the Social Security payments due to be sent to beneficiaries in June would most likely still go out.

What happens to Social Security if the government defaults?

She added that the Treasury might reduce the payments — maybe to 50% or 75% of what's been promised. “It could take both approaches. Which one it takes depends on what executive branch officials decide, and they will likely prioritize creditors and recipients of entitlement programs,” Erkulwater said.

- Japan. $1,098.2. 14.52%

- China. $769.6. 10.17%

- United Kingdom. $693. 9.16%

- Luxembourg. $345.4. 4.57%

- Cayman Islands. $323.8. 4.28%

Who owns the U.S. debt? There are two basic categories of debt owners: 1) the public, which includes foreign investors and domestic investors and, 2) federal accounts, also known as "intragovernmental holdings." Each category is explained below.

The National Association for Business Economics (NABE) on Monday predicted that gross domestic product — a measure of the value of goods and services — will rise 2.2% in 2024, a significantly more bullish forecast than what the group projected only two months ago.

Which countries hold the most US debt? Over the past 20 years, Japan and China have owned more US Treasurys than any other foreign nation. Between 2000 and 2022, Japan grew from owning $534 billion to just over $1 trillion, while China's ownership grew from $101 billion to $855 billion.

References

- https://www.marketplace.org/2023/11/07/why-is-china-selling-off-its-us-debt-treasurys/

- https://www.quora.com/Does-Russia-currently-hold-any-debt-or-loans-from-the-United-States

- https://www.cnn.com/2023/05/24/business/prepare-debt-default/index.html

- https://repo.kinu.or.kr/bitstream/2015.oak/14448/5/4.%20Jooyung%20Lee%2897~124%29.pdf

- https://thehill.com/opinion/international/4075341-china-is-in-default-on-a-trillion-dollars-in-debt-to-us-bondholders-will-the-us-force-repayment/

- https://www.deccanherald.com/world/japan-s-debt-dilemma-and-its-balancing-act-2750760

- https://www.cbsnews.com/news/debt-ceiling-deadline-default-impact-on-your-money-social-security-mortgage/

- https://finance.yahoo.com/news/top-20-countries-owe-us-175515001.html

- https://en.wikipedia.org/wiki/National_debt_of_the_United_States

- https://www.cbsnews.com/news/does-debt-relief-hurt-your-credit-score/

- https://www.fdiintelligence.com/content/data-trends/the-world-banks-top-10-biggest-debtors-82044

- https://www.investopedia.com/terms/e/external-debt.asp

- https://fiscaldata.treasury.gov/americas-finance-guide/national-deficit/

- https://www.investopedia.com/articles/economics/10/sovereign-debt-default.asp

- https://apps.irs.gov/app/understandingTaxes/teacher/whys_thm01_les01.jsp

- https://www.reuters.com/markets/europe/italy-2023-budget-deficit-overshoots-debt-still-falls-2024-03-01/

- https://www.fidelityinternational.com/editorial/article/how-china-keeps-its-debt-in-order-e1feea-en5/

- https://www.weforum.org/agenda/2023/12/what-is-global-debt-why-high/

- https://unherd.com/newsroom/us-deficit-to-exceed-1-5-trillion-in-2024/

- https://usafacts.org/articles/which-countries-own-the-most-us-debt/

- https://homework.study.com/explanation/what-would-happen-if-the-u-s-actually-paid-off-the-national-debt-where-would-the-banks-big-financial-institutions-and-government-foreign-and-domestic-put-their-cash.html

- https://www.imf.org/en/Topics/sovereign-debt

- https://www.wallstreetmojo.com/sovereign-debt/

- https://collins.house.gov/media/press-releases/collins-china-buying-us-farmland

- https://teachinghistory.org/history-content/ask-a-historian/23559

- https://www.quora.com/What-would-happen-if-the-USA-and-other-countries-stopped-trading-with-China

- https://www.nerdwallet.com/article/finance/find-debt-relief

- https://www.investopedia.com/articles/markets-economy/090616/5-countries-own-most-us-debt.asp

- https://www.forbes.com/advisor/investing/debt-ceiling-impact-money-market-funds/

- https://www.cbr.ru/eng/statistics/macro_itm/svs/ext-debt/

- https://en.wikipedia.org/wiki/Financial_position_of_the_United_States

- https://www.investopedia.com/articles/investing/080615/china-owns-us-debt-how-much.asp

- https://www.gao.gov/americas-fiscal-future/federal-debt

- https://globalaffairs.org/bluemarble/china-foreign-land-ownership-explainer

- https://www.investopedia.com/articles/investing/040115/reasons-why-china-buys-us-treasury-bonds.asp

- https://finaid.uccs.edu/types-of-aid/educational-loans/default15

- https://www.investopedia.com/terms/s/sovereignbond.asp

- https://www.thomsonreuters.com/en-us/posts/international-trade-and-supply-chain/global-trade-impacts-default/

- https://www.quora.com/Which-countries-have-never-defaulted-on-their-debts-apart-from-the-US

- https://www.imf.org/en/Publications/fandd/issues/2022/12/basics-what-is-sovereign-debt

- https://wallethub.com/answers/cc/what-percentage-of-america-is-debt-free-2140664784/

- https://budgetmodel.wharton.upenn.edu/issues/2023/10/6/when-does-federal-debt-reach-unsustainable-levels

- https://homework.study.com/explanation/what-would-happen-if-the-government-erased-all-debts-that-it-accrued.html

- https://www.visualcapitalist.com/government-debt-by-country-advanced-economies/

- https://www.pbs.org/newshour/politics/how-a-debt-default-could-affect-you

- https://www.investopedia.com/terms/s/sovereign-debt.asp

- https://www.bu.edu/articles/2023/what-is-the-sovereign-debt-crisis-and-can-we-solve-it/

- https://www.imf.org/en/Blogs/Articles/2023/09/13/global-debt-is-returning-to-its-rising-trend

- https://www.pgpf.org/top-10-reasons-why-the-national-debt-matters

- https://www.quora.com/How-much-does-America-owe-to-other-countries-and-how-much-do-those-countries-owe-America

- https://corporatefinanceinstitute.com/resources/fixed-income/sovereign-default/

- https://www.cnbc.com/2024/02/07/debt-crisis-is-in-the-making-and-it-wont-end-well-for-the-world-economist-warns.html

- https://brainly.com/question/11480949

- https://corporatefinanceinstitute.com/resources/fixed-income/sovereign-debt/

- https://www.vedantu.com/commerce/debt-free-countries

- https://worldpopulationreview.com/country-rankings/countries-by-national-debt

- https://www.businessinsider.com/personal-finance/average-american-debt

- https://en.wikipedia.org/wiki/Default_(finance)

- https://www.pgpf.org/blog/2024/02/debt-vs-deficits-whats-the-difference

- https://www.itsuptous.org/blog/who-does-us-owe-money-to

- https://asia.nikkei.com/Business/Markets/Bonds/Japan-investors-snap-up-U.S.-bonds-expecting-end-of-rate-hikes

- https://www.pgpf.org/national-debt-clock

- https://www.pgpf.org/blog/2024/04/how-much-is-the-national-debt-what-are-the-different-measures-used

- https://www.thebalancemoney.com/who-owns-the-u-s-national-debt-3306124

- https://www.forbes.com/advisor/retirement/debt-ceiling-impact-social-security/

- https://www.bis.org/publ/work1099.pdf

- https://www.debt.org/consolidation/companies/national-debt-relief/

- https://www.investopedia.com/articles/economics/11/successful-ways-government-reduces-debt.asp

- https://www.quora.com/What-happens-if-a-country-becomes-debt-free

- https://www.investopedia.com/terms/s/sovereign-default.asp

- https://www.investopedia.com/terms/b/budget-surplus.asp

- https://www.foxbusiness.com/politics/will-us-default-debt-jpmorgan-warns-odds-are-rising

- https://www.cnbc.com/2013/10/11/how-safe-is-your-money-if-the-us-defaults.html

- https://www.investopedia.com/ask/answers/051215/how-can-countrys-debt-crisis-affect-economies-around-world.asp

- https://en.wikipedia.org/wiki/Balanced_budget

- https://taxjusticeafrica.net/resources/blog/lopsided-global-financial-system-leaves-many-african-states-debt-distress

- https://www.marketplace.org/2023/11/10/what-happens-to-social-security-benefits-in-a-debt-default-or-a-government-shutdown/

- https://www.forbes.com/advisor/debt-relief/national-debt-relief-review/

- https://www.investopedia.com/articles/bonds/the-risks-of-sovereign-bonds.asp

- https://www.nationalpriorities.org/campaigns/us-federal-debt-who/

- https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

- https://www.cbsnews.com/news/inflation-economists-brighter-outlook-federal-reserve/

- https://quizlet.com/290594563/econ-2035-chapter-12-flash-cards/

- https://www.quora.com/How-can-the-USA-keep-printing-money-without-this-causing-any-real-problems-to-the-US-dollar-It-seems-like-every-time-they-need-more-money-they-just-pass-a-new-bill-and-off-to-the-printer-they-go

- https://en.wikipedia.org/wiki/National_debt_of_Japan

- https://www.cbsnews.com/minnesota/news/good-question-how-did-the-u-s-debt-get-so-high/

- https://www.investopedia.com/financial-edge/0911/7-things-you-didnt-know-about-sovereign-debt-defaults.aspx

- https://en.wikipedia.org/wiki/History_of_the_United_States_public_debt

- https://www.investopedia.com/ask/answers/12/safest-place-for-money.asp

- https://1997-2001.state.gov/issues/economic/fs_000301_wardebt.html

- https://www.statista.com/statistics/273488/countries-with-the-lowest-national-debt/

- https://www.taxpolicycenter.org/briefing-book/how-does-federal-government-spend-its-money

- https://www.investopedia.com/financial-edge/0611/june-20-5-ways-the-u.s.-can-get-out-of-debt.aspx